A Perfect Storm for Palantir

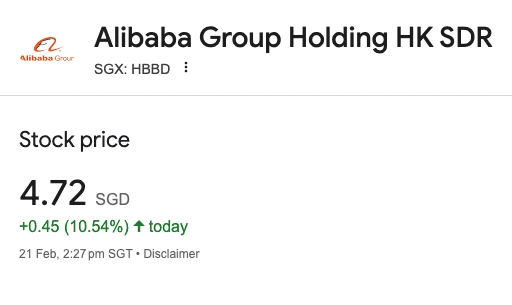

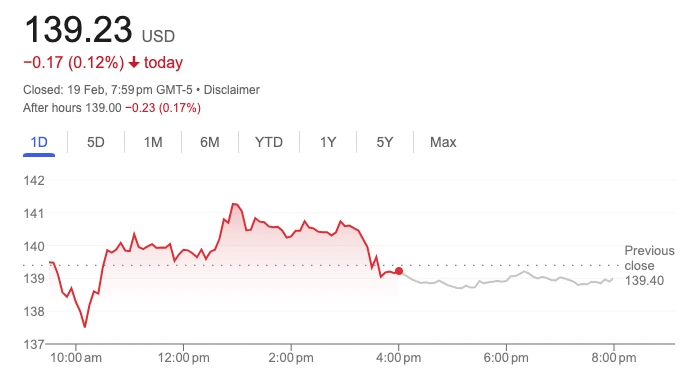

Palantir Technologies (NYSE: PLTR), once hailed as the "AI juggernaut," saw its shares plummet 12% intraday on February 19, 2025, closing at $112.06 amid dual crises: CEO Alex Karp’s plan to sell 10 million shares ($1.1B) and reports of Pentagon budget cuts targeting defense contractors. This sell-off erased $31B from its $260B market cap, exposing vulnerabilities in its government-reliant business model.

1. The Triggers: Why Palantir Stock Crashed

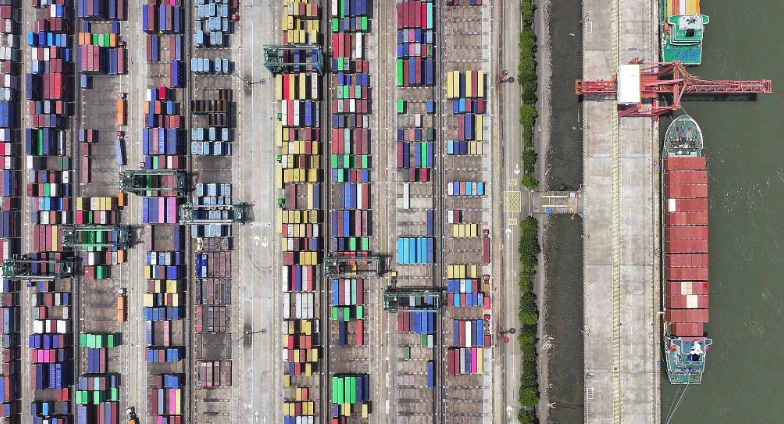

A. Pentagon’s 8% Annual Budget Cut Directive

The U.S. Defense Department, under Secretary Pete Hegseth, confirmed plans to slash 680B( 8850B budget over five years. For Palantir—which derives 55% of revenue from defense contracts—this threatens core projects like AI-powered battlefield systems and intelligence analytics platforms.

B. CEO’s Controversial Stock Sale

Karp’s scheduled sale of 10M shares (0.5% of his stake) through August 2025 triggered fears of insider pessimism. This follows his $385M sell-off in 2024, eroding confidence in Palantir’s near-term growth.

C. Tech Sector Valuation Pressures

With a sky-high P/E ratio of 600 and EV/EBITDA of 182, Palantir’s valuation hinges on flawless execution. Rising Treasury yields and sector-wide profit downgrades exacerbated the plunge.

2. Market Fallout: Trading Halts and Analyst Reactions

- Trading Volume Spiked 220% to 98M shares vs. 30M average.

- Morgan Stanley Downgrade: Cut rating to "Underweight," citing "unsustainable reliance on volatile government contracts."

- Short Sellers Capitalized: PLTR short interest surged to 4.8% of float, up from 2.1% in January.

3. Strategic Risks: Palantir’s Overexposure to Defense Spending

Palantir’s Foundry and Gotham platforms underpin critical U.S. military operations, including:

- Project Maven: AI-driven drone targeting systems ($900M contract).

- Joint All-Domain Command (JADC2): Centralized battlefield data network.

- COVID-19 Supply Chain Analytics: $300M in pandemic-era contracts.

A Pentagon budget squeeze could delay these initiatives, slashing Palantir’s projected 2025 government revenue growth from 22% to 9%.

4. Broader Implications for Defense Tech

The proposed cuts signal a Trump-era push for "leaner government," impacting key players:

- Lockheed Martin (LMT): Down 3.2% on F-35 program risks.

- Shield AI: Drone software startup valuation cut 15% post-news.

- Anduril Industries: Lobbying efforts intensify to protect autonomous systems funding.

5. Silver Linings: AI Innovation and Commercial Growth

Despite turmoil, Palantir’s commercial segment grew 38% YoY in Q4 2024, driven by:

- AIP (Artificial Intelligence Platform): Deployed at 400+ enterprises, including Siemens and Airbus.

- Healthcare Expansion: $200M NHS contract for patient data optimization.

- Energy Sector Wins: BP and Chevron adopted Foundry for emissions tracking.

CTO Shyam Sankar emphasized resilience: “Our AI infrastructure is battle-tested—whether in defense or boardrooms.”

6. Investor Guidance: Navigating the Volatility

A. Short-Term Caution

- Monitor Q1 2025 earnings (May 7) for revised government revenue guidance.

- Track Pentagon’s final budget proposal by March 15.

B. Long-Term Opportunities

- $25B Global Military AI Market: Palantir remains a top contender despite cuts.

- Commercial AI Adoption: Gartner predicts 70% of Fortune 500 will use Palantir-like tools by 2027.

C. Portfolio Strategies

- Diversify with cloud peers (AWS, Azure) less exposed to policy shifts.

- Consider put options at $105 support level for downside protection.

A Inflection Point for Defense Tech

Palantir’s crash underscores the perils of over-reliance on government spending. Yet, its AI expertise and commercial momentum suggest potential for recovery—if it can pivot swiftly. As Roth Capital’s Darren Aftahi noted, “The Pentagon storm will pass, but Palantir must prove its mettle beyond the battlefield.”